Healthy Financial Habits

In essence, healthy financial habits refer to regular processes or measures that individuals employ in managing their finances. This could encompass activity such as consistent saving, budgeting, investing and making prudent spending decisions. For instance, making a monthly budget, and adhering to it, is a healthy financial habit. Another example could be setting aside a certain percentage of income towards savings or investments.  These habits, while seemingly routine or mundane, play a significant role in promoting personal fiscal health and providing a solid foundation for future financial success.

These habits, while seemingly routine or mundane, play a significant role in promoting personal fiscal health and providing a solid foundation for future financial success.

Financial health, unsurprisingly, is of paramount importance. Good financial health, cultivated through healthy habits, affords individuals increased financial security and peace of mind. It diminishes stress related to financial issues and fosters a sense of control over one’s financial future. Furthermore, optimal financial health can lead to opportunities for improved quality of life, such as being able to afford a home or pursue higher education. Beyond the individual, excellent financial health promotes economic stability at a larger societal level. This importance accentuates the imperative of understanding, adopting, and consistently practicing healthy financial habits.

Establishing a Budget

Forging a successful budget cuts across several straightforward steps. It commences with the identification of income sources and quantification of the total earnings. Post that, they jot down fixed and variable expenses to get a grip over mandatory and flexible expenditures. With the data in hand, they sort expenses into different categories – housing, utilities, food, transportation, and so forth.  After comprehending one’s spending habits, they shape a realistic budget, anchoring the process with concrete financial goals. Altering their budget as per their fluctuating financial situation, and finally, tracking expenses, they stay within the set limit.

After comprehending one’s spending habits, they shape a realistic budget, anchoring the process with concrete financial goals. Altering their budget as per their fluctuating financial situation, and finally, tracking expenses, they stay within the set limit.

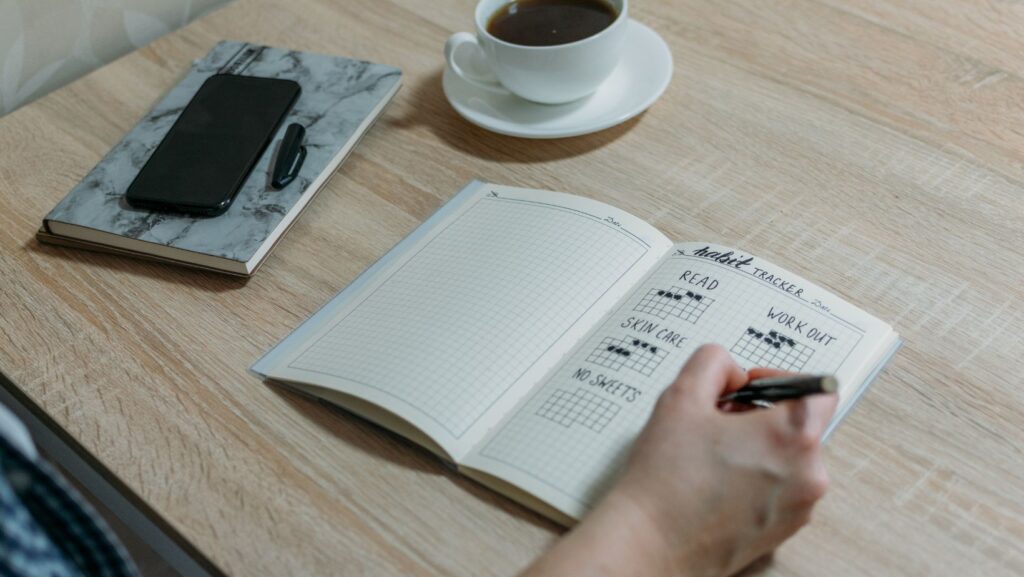

Budgeting can drastically simplify with the use of effective tools. Digital applications like Mint, YNAB (You Need a Budget), and Quicken provide continual tracking of income and expenses, automating budget management. Hybrid models like the Envelope system merge digital tracking with physical categorization of budget, making the process tactile and visual. Simplifying the task, spreadsheet programs like Microsoft Excel and Google Sheets allow users to create cutsomized budgeting templates catering to their specific needs.

Healthy Financial Habits in Daily Life

Healthy financial habits aren’t exclusive to major decisions or milestones, they permeate everyday life and simple choices. Recognizing this connection catalyzes the journey towards improved financial health. In the smaller choices, one can see the impact of financial health. Let’s take grocery shopping, for instance. A financially aware individual would opt for seasonal and local products, promoting cost savings. Checking and comparing prices of various brands, and taking advantage of deals and offers, can aid in managing finances without compromising on needs. Similarly, consider transportation choices. Opting for public transport, cycling, or walking over using personal vehicles can cut down significantly on fuel and maintenance expenses. A bike, for example, not only promotes physical health, but also lessens financial strain.  Sanjay, a 25-year-old software engineer, is an example of how consistent saving can lead to significant wealth. Starting his savings journey with just a portion of his salary, he applied the 50/30/20 rule, and within three years, managed to build an impressive safety net for unexpected expenses.

Sanjay, a 25-year-old software engineer, is an example of how consistent saving can lead to significant wealth. Starting his savings journey with just a portion of his salary, he applied the 50/30/20 rule, and within three years, managed to build an impressive safety net for unexpected expenses.

Likewise, Martha, a young entrepreneur, recognized the potential losses associated with her business. She wisely invested in business insurance, protecting her assets from unforeseen liabilities. This foresight helped stabilize her business and maintain financial health, even during tough times. Incorporating healthy financial habits into daily life assists in solidifying a sturdy foundation for improved financial health and prosperity. By making conscious and informed financial decisions, and learning from those who’ve embraced these habits, one can navigate their financial journey with confidence and security.Cultivating healthy financial habits is indeed the cornerstone of long-term financial well-being. It’s not just about saving and budgeting; it’s about integrating financial health into daily decisions. The simple choices we make, like grocery shopping or choosing transportation, can have a profound impact on our financial stability. It’s also about protecting against unforeseen events with the right insurance policies.